It’s coming to the end of the financial year and with the challenging economic environment, something us investors will want to be doing is assessing how their investments performed over the past 12 months.

We will want to do this to not only keep us sane, but also to gauge whether your property is performing better than (or comparatively to) other investment avenues such as a pension, stocks and shares and more.

We regularly discuss this with Home Share investors and have seen a number of different financial models, so thought we'd share some tips and suggestions here.

Reviewing profitability

The first point you will want to assess is profitability – both before and after tax.

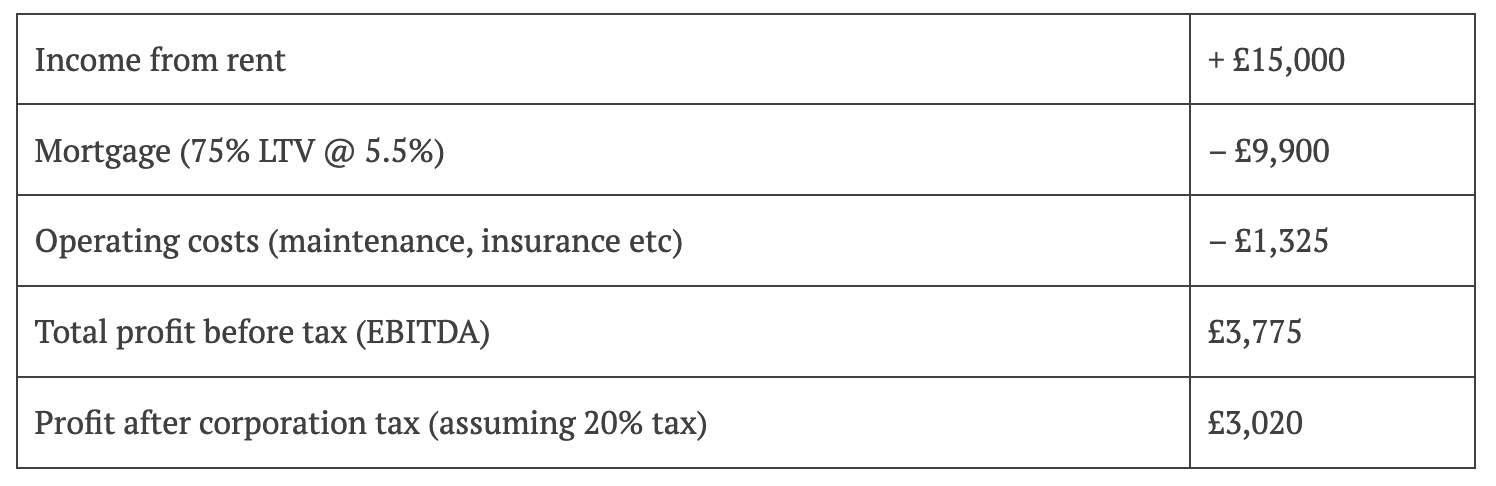

Whether you have one or multiple properties, we strongly recommend this and the model below is an excellent one to follow.

We have outlined this example based on a £240k single let property let at £1,250 per month, however this model can be applied to an HMO, serviced accommodation and more.

This illustration is based on properties held within a limited company, which is simpler for tax purposes.

we recommend breaking this down per property as well as breaking down for your portfolio as a whole.

You will see how, from this property, the total profit after an assumed 20% tax rate is £3,020 for the year.

Reviewing ROI

Calculating how much profit you are making is an important exercise, however almost more important as a measure is the rate of return on your investment.

For example, in the illustration above, a £240k property with a 75% LTV mortgage would require an investment of say £67,200 considering deposit and stamp duty.

Therefore, an important measure is the cashflow return on your investment as a percentage (We recommend doing this after tax):

Profit after tax or £3,020

Divided by the total investment or £67,200

Multiplied by 100 = 4.7%

You might consider this return, being under 5% as low when compared to a pension but remember that this is just cashflow and property (in a normal year) will also increase in value by around 2.5%.

We know this is not the case right now, but have covered this off in the next section around taking a long term view.

When measuring your ROI in that case, it’s helpful to have a separate figure outlining the return including this:

Assumed property value increase at 2.5% of £6,000

Plus profit after tax of £3,020

Divided by the total investment or £67,200

Multiplied by 100 = 13.4%

You will see how these two separate figures are helpful indicators of performance.

You might spot how we mentioned the cash return of 4.7% is lower than the average pension return of 7%, however do bear in mind that you have access to this cashflow now as opposed to waiting until a pensionable age.

Taking a long-term view

The last point to bear in mind when assessing performance is taking a long-term view.

We always recommend holding property for ten plus years before the numbers start getting exciting, however also bear in mind the unique economic circumstances we are currently in and how it’s likely mortgage rates will start heading back to the 4-4.5% mark in the coming years. If mortgage rates get to 4.5% the above illustration will reflect a 5.8% cashflow return and at mortgage rate of 4%, this will reflect a cashflow return of 7%.

In addition to mortgage rates, remember how rental rates should be on an upward trajectory as will property values meaning that the more time you hold a property, the stronger the returns should be.

In our view, property when done right continues to be, and always will be a very strong investment vehicle. It’s proven and we see no reason why it won’t be for many decades to come.